Comience a aceptar pagos.

Puede abrir una cuenta PayPal Empresas sin costo y comenzar a aceptar todas las formas de pago. Puede recibir pagos de forma más fácil mientras sus clientes disfrutan una experiencia de pago más rápida y más segura.

Pagos web

PayPal es una de las formas más populares de recibir pagos en línea y en dispositivos móviles. Acepte tarjetas y pagos de PayPal fácilmente y de manera más segura.

Más acerca de pagos web (Pagos web)

Generación de recibos PayPal en línea

Reciba pagos con mayor rapidez enviando los recibos por correo electrónico a sus clientes. Pueden comprar de forma más segura con el clic de un botón, sin compartir la información financiera al pagar.

Más información sobre la generación de recibos PayPal en línea (Generación de recibos PayPal en línea)millones PayPal tiene más de millones de cuentas activas en 202 países y regiones alrededor del mundo.

Haga crecer su empresa con PayPal.

Comience de a poco y crezca, o bien, sea grande ahora. Queremos ayudarle a aumentar sus ventas.

Obtenga pagos sin un sitio web

- Reciba pagos más rápido y de forma más segura.

- Vender en eBay.

- La seguridad es nuestra prioridad

Pagos exprés

- Acepte todos los pagos.

- Elija la solución indicada para usted.

- Sus ventas están protegidas.

Soluciones globales

- Aceptamos 25 divisas.

- Estamos disponibles en 202 países.

Más que solo pagos.

Más que solo una solución de pago completa, PayPal le ofrece herramientas que le ayudan a crecer y a vender más.

Botones y logotipos de PayPal

Obtenga todo que necesita colocar en su página de inicio y en la página de pago: logotipos, botones de PayPal, banners, formas de pago que se aceptan y más.

(Botones y logotipos de PayPal)

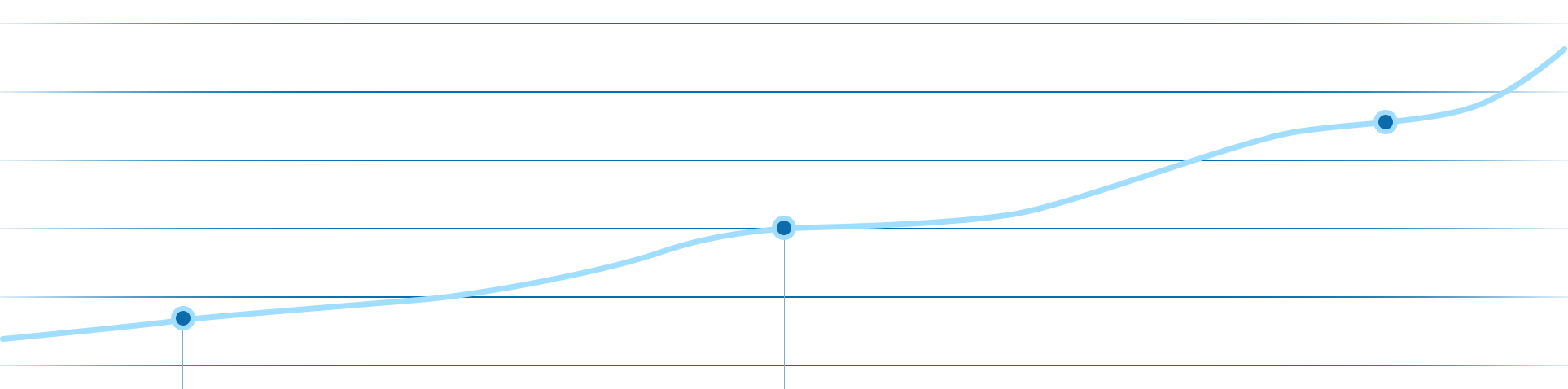

Pautas y estadísticas

Obtenga datos útiles de comportamientos claves de los consumidores en distintos países, de manera que pueda aumentar las ventas en línea y a través de dispositivos móviles.

(Pautas y estadísticas)